Table of Content

The hardship withdrawal option allows first-time home buyers to withdraw $10,000 from their 401k without incurring the 10% IRS penalty. However, buyers will have to pay income tax on this withdrawal come tax season. The First-Time Home Buyer Tax Credit Act is working its way through Congress.

In 2020, there were an estimated 1,782,500 first-time homebuyers, 2.7% less than 2019’s figure of 1,734,150. As part of Budget 2018, the Provincial Government announced the new Home Purchase Program and enhancements to the newly renamed First-time Homebuyers Program to assist individuals and families become homeowners. "Our mission at WOWA.ca is to empower Canadians by providing accurate and intuitive financial tools & guides, along with market reports, so that everyone can make more informed financial decisions."

Consider a Conventional 30-year, Fixed-Rate Mortgage

The lowest average age of first-time homebuyers in the last 40 years was in 1991 when it dipped to 28 and it has not been this low since. The below graph shows the average age of first-time homebuyers since 1981, some years are missing as the data was not collected every single year. The program will be extended to March 31, 2019, with available funding of $1.25 million, and will assist an estimated 100 households to secure home ownership. Buying a home is a legal transaction so it’s common to have two real estate agents attached to each purchase. The other real estate agent works for the seller’s best interest. The FHA maintains a list of state and local down payment assistance programs on its website.

All loans are subject to ID verification and consumer report review and approval. Improvement in your credit score is dependent on your specific situation and financial behavior. Failure to make monthly minimum payments by the payment due date each month may result in delinquent payment reporting to credit bureaus which may negatively impact your credit score. This product will not remove negative credit history from your credit report. All Certificates of Deposit are deposited in Lead Bank, Member FDIC, Sunrise Banks, N.A., Member FDIC or SouthState Bank, N.A., Member FDIC.

Look For Automatic Down Payment Assistance

In early 2018, the provincial government in Newfoundland and Labrador announced some changes to their home-buying incentive programs. The Home Purchase Program is a new initiative to make it easier for the average first-time buyer to save up a down payment for a newly built home. The program is expected to help hundreds of residents over the next year, while stimulating economic growth in the province.

Buyers with high credit scores get significant adjustments, too. In late 2022, the Federal Housing Finance Agency discounted interest rates to make homes more affordable for first-time buyers. The Downpayment Toward Equity Actis a home buyer grant that awards up to $20,000 cash to first-generation home buyers, plus an additional $5,000 to buyers with socially or economically disadvantaged backgrounds. Millennials are the most likely generation to be making plans to purchase a home within a year (19%), followed by Gen Z (13%) and Gen X (12%). In contrast, only 5% of Boomers reported plans to purchase a home.

First-time homebuyer demographics

If you’re living in co-operative housing, the property qualifies if you have equity interest. It’s either an existing home or a newly built home purchased after January 27, 2009. If you’ve been considering using your 401k to secure a down payment for your home, take a look at the pros and cons of utilizing these funds and some alternative options available for first-time buyers. Clever’s Concierge Team can help you compare local agents and find the best expert for your search.

Recipients must have an average credit rating, qualify for an FHA loan, and agree to use a 30-year fixed-rate mortgage, among other qualifications. Home buyers who use down payment loans may limit their mortgage options to FHA or conventional financing, so check with a lender before applying. Mortgage rate discounts for first-time buyers vary based on credit score, down payment size, and property type. Most state and local housing grants require buyers to meet minimum credit rating standards and earn an income within the lower two quartiles for the area. A first-time home buyer grant is a cash award paid to new US homeowners. Governments award grants on the local, state, and federal levels.

The average median take-home income of first-time homebuyers is $47,952, while the average repeat buyer has $50,479 to spend on a home.This amount varies drastically per state and metropolitan area. This comes from the same down payment analysis that worked out the average first-time buyer demographic and calculated the salary using statistics from the Bureau for Labor Statistics. For total homebuyers however, which includes both repeat and first-time buyers, there are almost double the number of women than men buying property in the country (17% vs 9%).

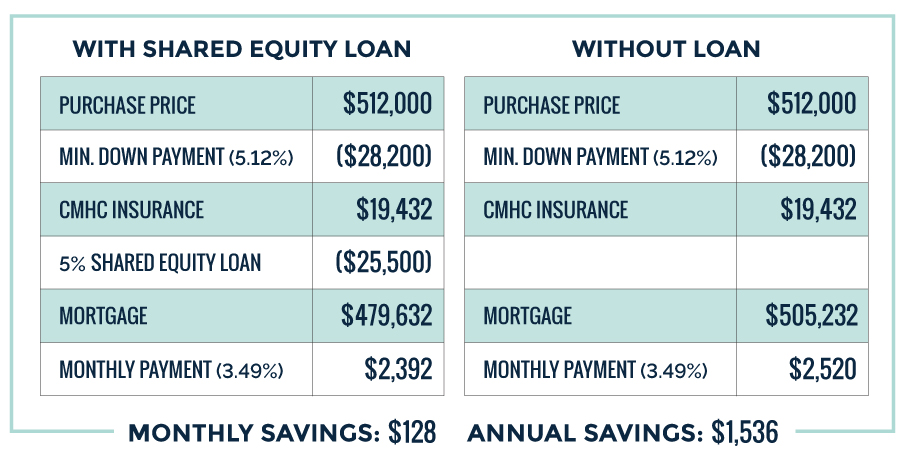

Real estate agents are trained salespersons and often licensed. They present and manage offers, negotiate contracts, and oversee transactions to purchase a home. Mortgage Calculator – Explore rates, payment frequency, amortization options and more. The homebuyer must repay the Incentive after 25 years, or when the property is sold, whichever comes first. The homebuyer can also repay the Incentive in full any time before, without a pre-payment penalty.

Under the Home Owner Grant, you may be eligible to lower the property taxes you’re required to pay on an annual basis for your principal residence. When you contribute funds to your Registered Retirement Savings Plan , that money is sheltered from tax until you withdraw it later on, in retirement. The Home Buyers’ Plan can make it significantly easier to save up what you need for the purchase of a qualifying property for yourself or someone with a disability.

Tax credits are reductions to a person’s federal tax liability to promote specific buyer behaviors, including buying a first home. Five years later, if the buyer still lives in the home and has made on-time payments as agreed, the lender will write off the smaller $15,000 mortgage. Our advice is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home.

Before you start the mortgage application process, pull your credit report at AnnualCreditReport.com and correct any mistakes that you find. This is an important step in getting pre-approved (which is much better than pre-qualified) for a mortgage. If the report looks good, it’s time to shop around, which according to the NerdWallet survey is another minefield for first-timers. Half of buyers applied to just one lender, which cost them about $430 in interest in the first year for a fixed-rate $260,000 mortgage. When you run your numbers, you will consider mortgage principal and interest, homeowners insurance, and taxes.

By earmarking such a large sum specifically to relieve the pressure facing this market segment, "the government will send a clear signal to society that we really want to help these groups," he said. PEI does not allow you to re-qualify as a first-time homebuyer, as you might be able to do under the Home Buyers’ Plan. You’re a first-time home buyer, having completed the Declaration – First-time Home Buyers form, signed by a notary public or a commissioner for taking affidavits. Successful applicants would not be required to begin paying back the repayable loan portion for five years after the purchase of a home; the most an applicant would repay in any given month would be just over $100. Grants of $3,000 will be provided to qualifying individuals and families toward the down payment on a new home valued up to $400,000 including HST. You must prove that you have not owned a residential property in Québec in the last five years, including as a result of an inheritance.

Both these scores would fall under VantageScore’s 'Good' range, which is used in this analysis rather than FICO. One of our recent analyses looked at first-time buyers' down payment amounts, and we found that the average first-time homebuyer down payment amount across the country is $8,220. For repeat buyers, this amount was $51,584 if using a 16% down payment. This is based on a huge variety of datasets, as well as the fact that the average down payment amount for first-time buyers is 6%, rather than the commonly referenced 20%. Buying a first home is typically the largest financial decision and commitment most people will ever make.

Many may look to their 401k to come up with the large sum required to buy a home. To find your assigned FHFA first-time buyer mortgage rate discount, get a complete pre-approval, including a credit score and income check. In the fourth quarter of 2019, first-time homebuyers represented 39% of all buyers in the single-family housing market, and 55% of all purchase money borrowers. Overall in 2019, first-time homebuyers represented 38% of all homebuyers in the single-family housing market and 56% of all purchase money borrowers. Automatic down payment assistance is often issued as tax credits or cash grants from a federal entity. Automatic assistance includes the proposed $15,000 First-Time Home Buyer Tax Credit, which the IRS credits; and, the LIFT Act which is a joint stimulus between the FHA and the U.S.

No comments:

Post a Comment